Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin has officially been given the green light and is now accepted by Governments and Wall Street. This is because a Bitcoin ETF has been announced which means cryptocurrency is legitimised once and for all and I’ll explain how.

An ETF (Exchange-Traded Fund) is a type of investment you can buy on stock exchanges, just like a regular stock.

Some ETFs follow things like the S&P 500, which is a group of 500 big companies. Others follow things like the price of gold.

ETFs make investing more simple, instead of buying hundreds of different stocks or a full bar of gold, you can buy one ETF and instantly own a small slice of everything inside it. This spreads out your risk and saves time and money.

In short: ETFs make it easy to invest smartly, without needing to be an expert.

To create an ETF, a company has to apply to financial regulators, like the SEC (Securities and Exchange Commission) in the U.S. The rules are strict, and many applications don’t get approved.

It’s not easy – the ETF must follow certain rules, be safe for investors, and be clearly explained. Big financial firms like BlackRock or Vanguard usually apply, and the SEC reviews and decides if it can be approved and traded.

So while ETFs might seem simple to buy, getting one approved is a long and difficult process.

This is why it is such a big deal that Bitcoin finally got approved for an ETF.

It means Bitcoin is now being treated more like a real, trusted investment, similar to stocks or gold. The fact that the SEC approved it shows that Bitcoin has matured and passed serious checks for safety, transparency, and structure.

Now, big investment firms and regular people can buy into Bitcoin easily through traditional platforms—without needing to deal with crypto wallets or exchanges. This gives Bitcoin more legitimacy, trust, and access, which can lead to more adoption, more money flowing in, and stronger long-term growth.

A Bitcoin ETF means crypto now has a seat at the Wall Street grown-ups’ table.

When something gets an ETF, it becomes way easier for big money to invest—pension funds, banks, and everyday investors who wouldn’t touch the asset before.

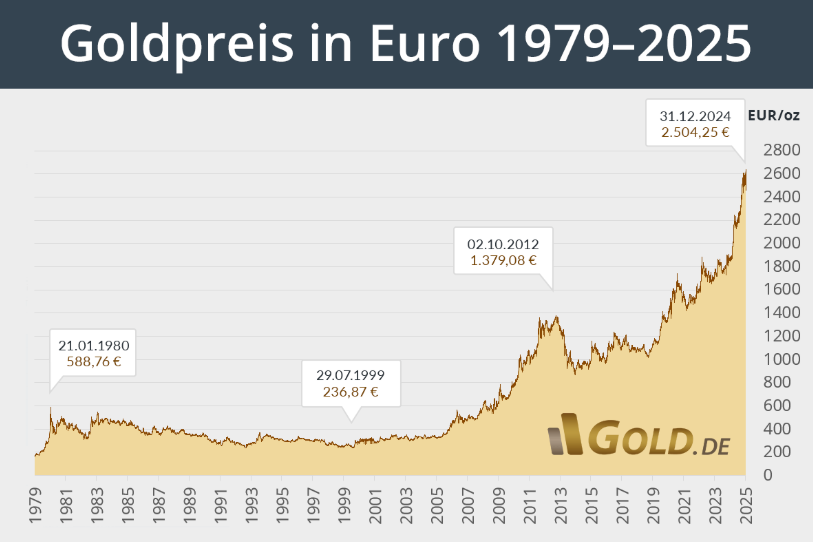

That’s what happened with gold. Before the gold ETF launched in 2004, it was hard to invest in gold. But once it got an ETF, billions flowed in. Over the next few years, gold’s price went up nearly 4x.

Now think about Bitcoin. It’s faster, scarcer, and built for the digital world. And now, with an ETF approved, we’re at the beginning of the same kind of shift—but possibly way bigger.

Bitcoin has real potential to become the most successful ETF of all time.

Why? Because it’s not just a store of value—it’s a revolution in money. And the ETF opens the floodgates.

If gold got a 4x boost, Bitcoin could do even more. We’re not guessing here—we’re watching history repeat, just in a much bigger way.

✅ Bitcoin has officially been approved for an ETF, meaning it’s now accepted by governments and Wall Street.

📈 ETFs (Exchange-Traded Funds) let people invest in a group of assets through one simple purchase, like stocks or gold.

🔐 Not everything can become an ETF—it’s a strict, complex process approved by regulators like the SEC.

🪙 Bitcoin passing this process proves it’s now seen as a legitimate and trustworthy investment.

💼 This approval allows big investors and everyday people to invest in Bitcoin easily, without needing crypto wallets or exchanges.

🏛️ Bitcoin now has a seat at the “grown-ups’ table” with traditional finance.

📊 Gold saw a 4x price increase after its ETF was launched, and Bitcoin could see even greater gains.

🚀 This could be the start of a huge wave of adoption and investment—Bitcoin might become the most successful ETF ever.