Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Stocks and crypto are two of the most popular ways to invest your money— stocks might make you a little less poor over time. Crypto has the power to change your life completely—taking you from ordinary to wealthy faster than anything. If you don’t understand the difference, you could miss the biggest opportunity of our lifetime.

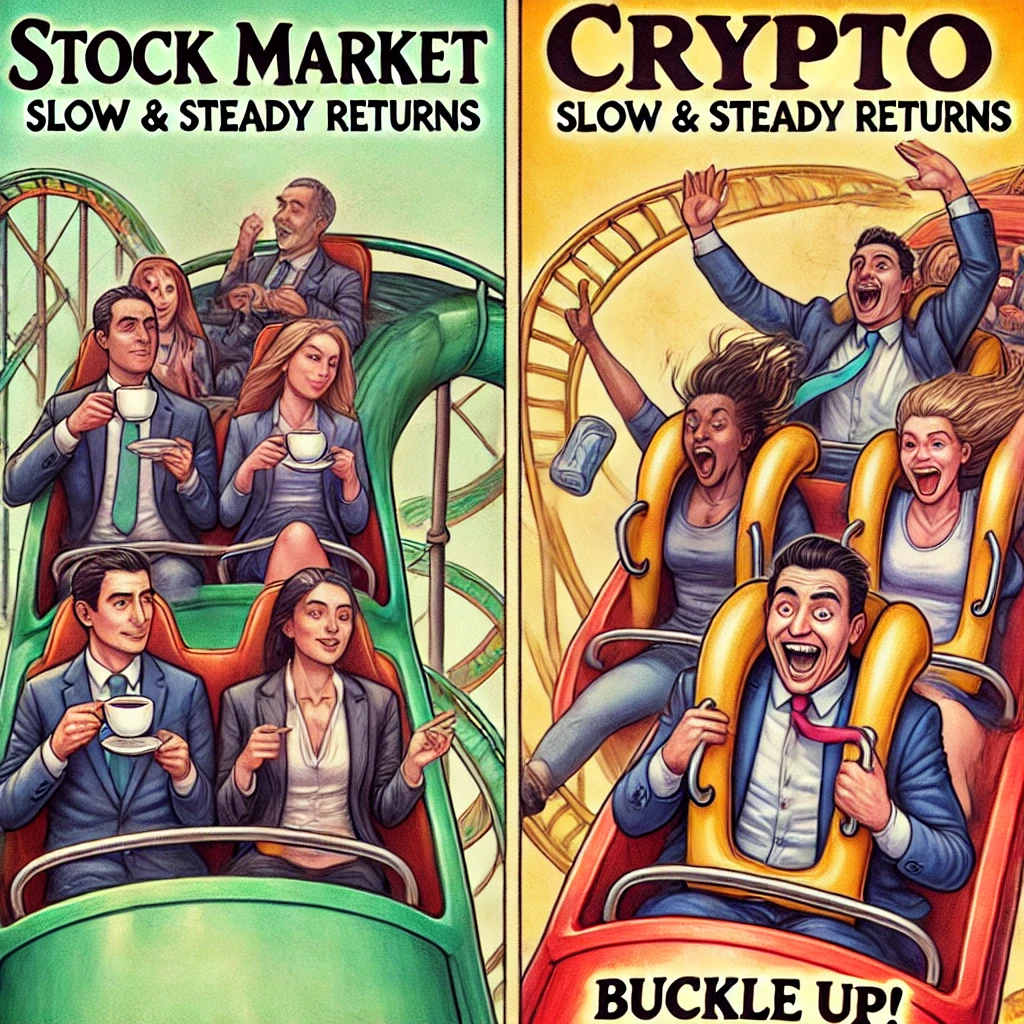

One is traditional, slow, and steady and follows the old rules of finance, the other is creating an entirely new system. Understanding the difference between both is vital to understand why crypto has the crazy potential it does.

Cryptocurrency is a wealth generator, while stocks are wealth preservers.

With crypto, there’s potential to completely transform your financial situation—thousands of investors in recent years have seen life-changing gains. In contrast, stocks (like those in the S&P 500) are safer and more stable, making them great for maintaining wealth, growing funds slowly over time. Better if you already have money to invest.

If you’re looking for steady, reliable returns, stocks are a good option. But if you want high growth potential and the chance to get in early on a financial revolution, crypto offers far more upside. 🚀

A stock represents ownership in a company. When you buy Apple stock, you own a small piece of Apple. If Apple makes more money, the stock price generally goes up. If Apple struggles, the price goes down. The price of a stock changes based on company performance, news, and market demand.

Stocks are traded on stock markets like the New York Stock Exchange or NASDAQ and they are relatively easy to buy and sell. The stock market is open and can be traded during market hours on weekdays (9am-4/5pm).

Stock Investors make money in two ways:

✅ Stock price increases – You make a profit by selling for more than you bought. For example, if you buy 10 stocks at £10 each (£100 total) and sell them later at £12 each, you earn £2 profit per stock—£20 in total.

✅ Dividends – Some companies divide up and share profits with shareholders.

The stock market is heavily regulated by government agencies like the SEC (in the U.S.) to ensure fair trading, prevent fraud, and protect investors—unlike crypto, which operates with far less oversight.

When you buy cryptocurrency, you’re buying digital money or tokens that run on something called a blockchain. These tokens can be used for payments, investing, or powering apps. Unlike stocks, you’re not investing in a company—you’re investing in technology and a new type of digital system. Cryptocurrencies are not organisations, they can be created and tied to a company or physical entity, but they are completely separate. When you buy a cryptocurrency you own a piece of a digital currency/asset, not a company.

The value of cryptocurrencies changes based on news and demand. For example, if a government announces they’ll use Bitcoin as legal money (like El Salvador did), more people rush to buy it—so the price goes up. Big companies like PayPal or Visa supporting crypto can also cause prices to rise because people believe it’s becoming more valuable.

Cryptocurrency is all traded online is open to buy or sell 24/7. Cryptocurrency values are much more volatile and subject to rapid shifts in price. One reason for this is because it operates in a market that is still evolving and less regulated than the stock market.

How cryptocurrency investors make money:

✅ Price Appreciation – MOST COMMON, Buy cryptocurrency at a low price and sell it at a higher price to make a profit.

✅ Staking – lock up your cryptocurrency in a network to earn rewards.

✅ Mining – Cryptocurrency tokens need to be created through complex mathematical puzzles on computers. If you use your computational power to do this you earn cryptocurrency as a reward.

✅ Airdrops – You receive free cryptocurrency from a project. For example, holding a specific token could qualify you for an airdrop of a new token.

✅ Crypto Savings Accounts – You deposit cryptocurrency into a savings account and earn interest over time. For example you place your coins in a crypto savings account could earn you interest, sometimes up to 10% APY.

Stocks are highly regulated by governments and financial institutions, meaning:

Crypto, on the other hand, while it offers huge potential for growth, it’s important to understand the risks. Prices can be extremely volatile—sometimes moving 20% or more in a single day. Unlike the stock market, which is heavily regulated to protect investors, crypto is still mostly unregulated right now. That means there’s a higher chance of scams, fraud, or sudden project failures (often called “rug pulls”).

If you lose access to your digital wallet or private keys (where your crypto is stored), there’s no bank or recovery process—you could lose your crypto for good. This is why it’s important to do your own research, invest only what you can afford to lose, and stay informed as the crypto space continues to evolve.

💡 Crypto regulation is evolving fast—some see it as necessary, while others fear it will limit crypto’s true potential.

Stocks depend on companies doing well in their industry. Crypto is bigger than that—it’s a whole new financial system that any business, government, or individual can use. Just like the internet revolutionised communication, crypto is transforming how money, contracts, and data work globally.

Instead of just owning part of a company, crypto lets you invest in the infrastructure of the future. 🌎💡

Right now, the global stock market is worth $110+ trillion, while crypto sits under $3 trillion. That means crypto is still in its early days, with massive room to grow.

📈 Stock Market: Predictable, steady growth (~8-10% per year).

🚀 Crypto: Can multiply 5x, 10x, or even 50x in a short time.

For example:

There is 100s of these examples!!

The stock market is already mature—while crypto is still expanding, offering early adopters the highest upside. The question is: Do you want slow, steady returns, or the chance to be part of the next financial revolution? 👀