Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

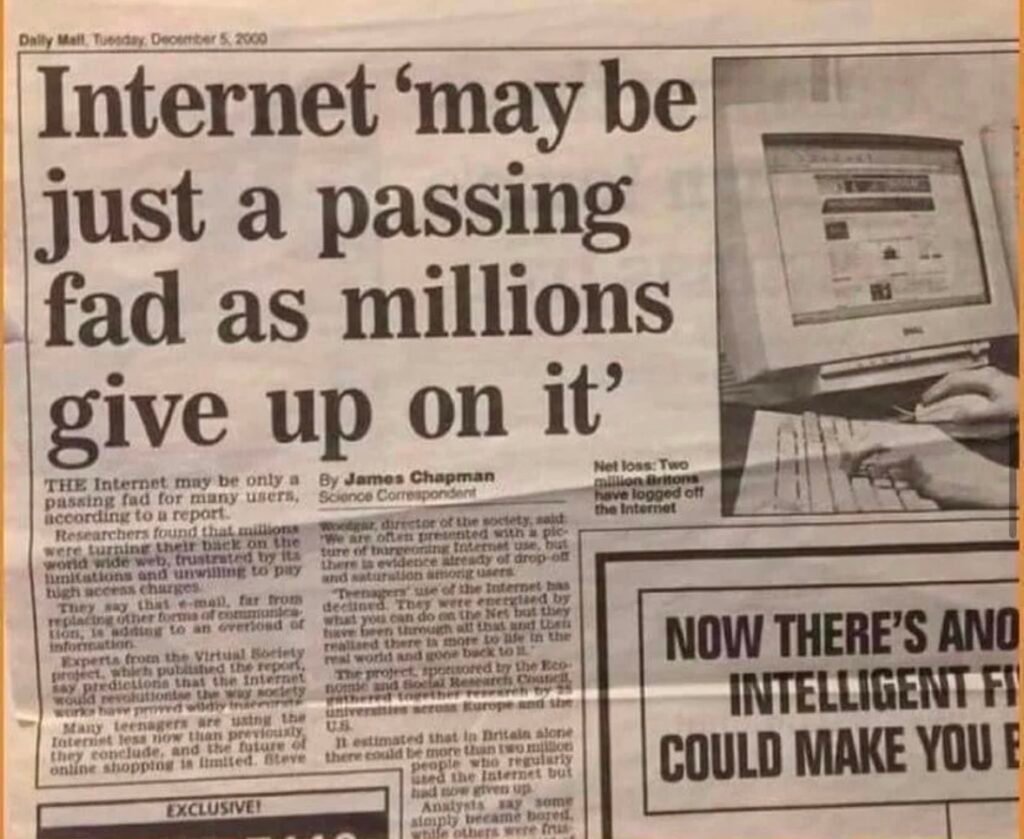

In the 1990s, the internet was laughed at. People called it a fad. Governments didn’t know how to regulate it. Businesses ignored it. Fast forward 30 years — and it’s the foundation of modern life.

Now, crypto is walking that same path. Criticised and misunderstood, but quietly building the future.

In this post, we’ll look at how the rise of crypto today mirrors the early days of the internet — and why that should give every investor serious déjà vu.

In the 90s, the internet didn’t look like the world-changer it became. It was slow, clunky, and confusing. You had to sit through loud dial-up sounds just to load a basic web page.

Most people didn’t understand what it was or why they’d ever need it.

News anchors mocked it on TV. Business leaders dismissed it. Governments had no clue what to do with it.

“Why would anyone need email when you can just send a letter?” — was the mindset back then.

And yet, a small group of people did see the vision. Developers, early adopters, and innovators started building websites, tools, and networks that would later become the backbone of the internet we know today.

The early internet was full of scams, failures, and wild speculation — but underneath that chaos was real innovation.

Now fast forward to crypto in 2025.

People say the same things:

“It’s too risky.”

“It’s for criminals.”

“It’s not real money.”

Governments are still trying to figure out how to regulate it. Most of the world still doesn’t really understand it. And like the early internet, it’s full of noise — hype coins, scams, and wild price swings.

But beneath that chaos, real innovation is happening. Blockchain technology is set to revolutionise how the world operates from banking to storing/sending data or messages. Networks are being built that can process thousands of transactions a second. Things like De-Fi (Decentralised Finance) have been created and are removing middlemen from finance, giving the people more power and control over their finances.

Stablecoins are already being used around the world to store value and send money across borders instantly, without having to worry about exchange rates or getting hit with hefty fees and middlemen are taking less of a cut, so you have more money left over in your pocket!

In 1995, only about 1% of the world used the internet.

Today, only around 5% of the world actively uses crypto.

The numbers are different — but the story is the same.

What made the internet explode wasn’t when people understood it — it was when it became useful.

Once websites got faster and user-friendly, adoption skyrocketed. People didn’t need to understand “TCP/IP” or “HTML” — they just wanted to send an email, watch a video, or buy something online.

Crypto is heading in that same direction.

Most people won’t care about “blockchains” or “smart contracts.”

They’ll use crypto without realising it — when they send money overseas instantly, own digital assets, or invest in tokenised versions of real-world things.

The internet didn’t need everyone to understand it — it just needed to become useful.

Crypto’s on that same path right now.

The story of the internet teaches us three big lessons:

Crypto won’t replace the old financial system overnight. But it is quietly building the rails for the next version of it — a system that’s open, safe, borderless, and digital-first.

When the internet first appeared in the 1990s, even some of the smartest people on the planet mocked it.

Experts called it a fad, newspapers said it would never last, and famous names like Robert Metcalfe, Clifford Stoll, and Paul Krugman all made bold predictions that aged terribly. By the time Amazon, Google, and eBay took off, those same critics had been proven wrong — and the internet had become the backbone of modern life.

Fast forward to crypto, and the story’s repeating itself.

Jamie Dimon—CEO of JPMorgan, the world’s largest bank—called Bitcoin “a fraud.” Warren Buffett—legendary investor and CEO of Berkshire Hathaway—labelled it “rat poison squared.” But notice what’s happened since: Dimon still says he personally isn’t a fan, yet JPMorgan now gives clients access to Bitcoin exposure, runs its own blockchain (Onyx), and uses JPM Coin for real-world settlements. Buffett still says he won’t buy Bitcoin directly, yet Berkshire has backed fintechs like Nubank, which offers crypto to millions of customers—that’s indirect participation, whether they love it or not.

Even governments that once dismissed crypto are now building or testing digital currencies and blockchain rails. The pattern is the same as the 90s: doubt first, adoption later. The internet changed how we share information; crypto is changing how we share value. We’ve seen this movie before—and we know how it ends. The only question is whether you’ll watch from the sidelines…or start building inside it.

Neither the internet nor crypto has been perfect — far from it. Every new technology has a dark side in its early days, and people always find ways to take advantage before the systems mature.

When the internet first exploded, scams, viruses, and fake websites spread everywhere. Email fraud became a global problem. People lost money to dodgy “get rich online” schemes and fake online stores. Governments and users had to learn the hard way how to stay safe online.

Crypto is going through the same phase. There are rug pulls, hacks, and fake projects, and those stories grab the headlines. But just like with the internet, that doesn’t mean the entire technology is bad — it means the world is still learning how to use it safely.

Even something as simple as the telephone faced this. When phones became common, scammers immediately started using them to trick people — yet nobody called for banning phones. Over time, better security, education, and regulation made them safe and essential.

It’s the same with crypto. Every major invention goes through a “chaos phase” before society builds the rules and tools to make it trustworthy. We’re still in that early, messy stage — but history shows what comes next: growth, maturity, and mass adoption.

There’s a famous saying in investing which says ‘history does not repeat,but it rhymes.’ Just like the internet in the 1990s, crypto today is mocked, misunderstood, and messy on the surface, yet quietly laying the groundwork for a revolution underneath. The doubters will always come first, but so will the builders. And just like the internet became the backbone of modern life, crypto will become the backbone of modern value — open, borderless, and unstoppable.